Bitcoin has fallen below $100,000 for the first instance in several months.

As of Friday’s publishing date, Bitcoin has been hovering between the $94,000 to $97,000 bracket. This price represents the lowest point since early May and is a notable drop from the more than $126,000 all-time peak reached just last month.

What’s going on?

Cryptocurrency is infamous for its extreme fluctuations, experiencing unpredictable changes due to numerous factors. A key reason for this recent Bitcoin drop is the prevailing sentiment regarding the economy.

The stock market is also in decline currently, and typically, cryptocurrency markets tend to mimic Wall Street trends. Moreover, some analysts are pointing to the anticipation that the Federal Reserve will reduce rates in December, resulting in decreased institutional buying in recent weeks.

Selloffs by crypto whales often have a substantial effect on the market during sudden declines. Yet, this time, many holders, not solely whales, are reportedly liquidating Bitcoin.

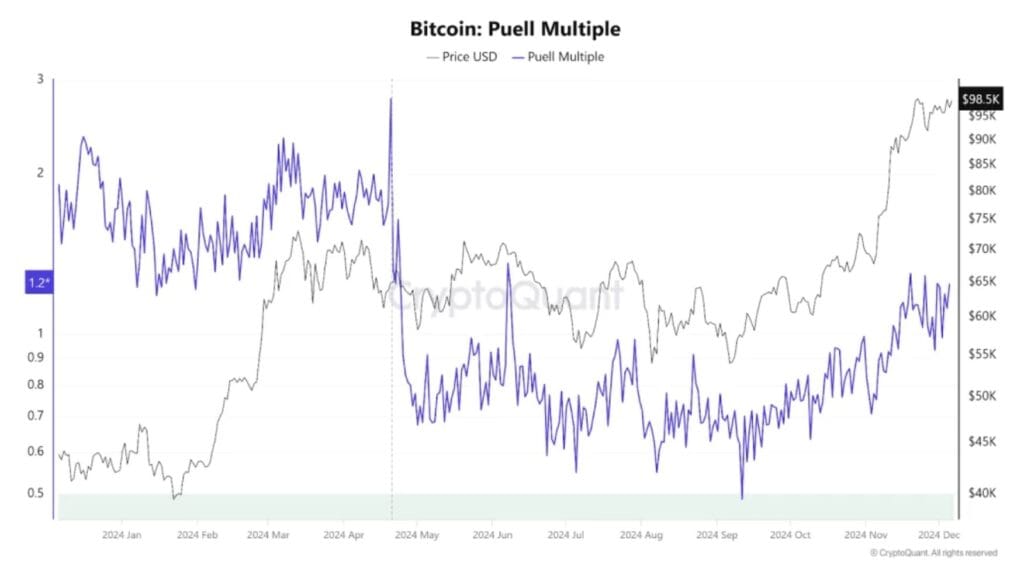

As per recent data from the cryptocurrency analytics firm CryptoQuant, long-term Bitcoin holders have offloaded approximately 815,000 BTC in the past 30 days, marking the highest level of activity since early 2024.

Bitcoin has been flourishing since President Donald Trump’s election in 2024. The crypto lobby backed his campaign, yielding favorable outcomes. The Trump administration has relaxed crypto regulations, appointed officials favored by the cryptocurrency sector, and ceased investigations into crypto-related offenses. For example, just last month, Trump granted a pardon to the founder of cryptocurrency exchange Binance, who was sentenced to prison for money laundering.

Nonetheless, a relatively small segment of the population actually engages in cryptocurrency trading. This indicates that the decisions of long-term holders and crypto whales can profoundly affect the market; this dynamic, coupled with the tepid market sentiment, is likely what we are witnessing now.